Mr. Abimbola Babalola, NGX’s Head of Trading and Products, has emphasised that investors need to peaceable search the suggestion of with professionals forward of investing in shares within the stock market.

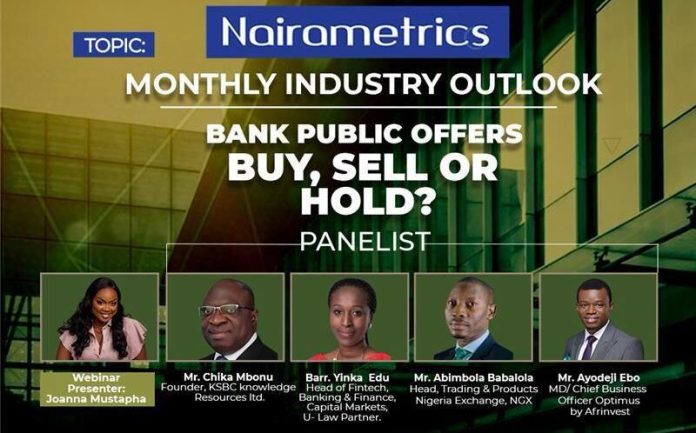

He made this commentary at some level of the Nairametrics Exchange Outlook webinar, titled “Banking Public Provides: Buy, Promote, or Protect,” which held on August 24, 2024.

According to him, in search of out professional steering forward of investing in a stock would aid investors comprehend the market risks and earnings linked with buying for shares.

‘’Investors that look professional suggestion may perchance per chance be higher suggested that stocks transfer up and down attributable to of market forces. And it will sever the effort that comes from seeing stocks decline; which they naturally compose”

Market Sentiment will not be any longer sufficient

He acknowledged that investors need to peaceable no longer hinge their decisions to make investments in stocks or assorted financial sources on market sentiment alone.

‘’Experts most frequently look beyond the sentiments over a firm, scanning for knowledge in regards to the firm’s performance, which shall be gotten from financial statements.’’

‘’The macroeconomics surrounding the firm which the investor is appealing to procure their stock issues, and only a professional will bid you about it.”

Other discussions

Transferring on, he remarked that “the NGX has put the stock market into the fingers of investors.”

He emphasised the importance of investors visiting the NGX internet situation to be taught more in regards to the firm’s performance and contemporary developments.

In his notion, the digitalization of investments has helped to rob away the barrier that beforehand stopped of us from having entry to stocks and the financial market in overall. He emphasised the convenience with which investors can entry stock market knowledge from the NGX internet situation.

What to know

The webinar additionally featured discussions that analyzed the impact that the 2005 recapitalization program had on the advance of Nigerian banks currently.

- Talks about how financially solid Nigerian banks changed into after 2005’s protection held sway on the webinar, because the more than a couple of audio system on the webinar expounded on how well-known it has been.

- Furthermore, there were discussions about how recapitalization has brought banks closer to investors by the employ of making the direction of of owning more shares very easy.

- Talks in regards to the lengthy-term outlook of the banking sector after recapitalization additionally held sway on the webinar because the audio system weighed in on the lengthy-term advantages that empowering banks with sufficient capital would include on the nation.

The webinar ended with the audio system attributing lengthy-term success to the recapitalization direction of. Hence, investing in banking stock or any assorted security need to peaceable be done with a lengthy-term perspective.