![]()

contributor

Posted:

- There is a definite correlation between Bitcoin and the S&P 500

- Bitcoin miner reserves could additionally fair be price keeping an survey out for too

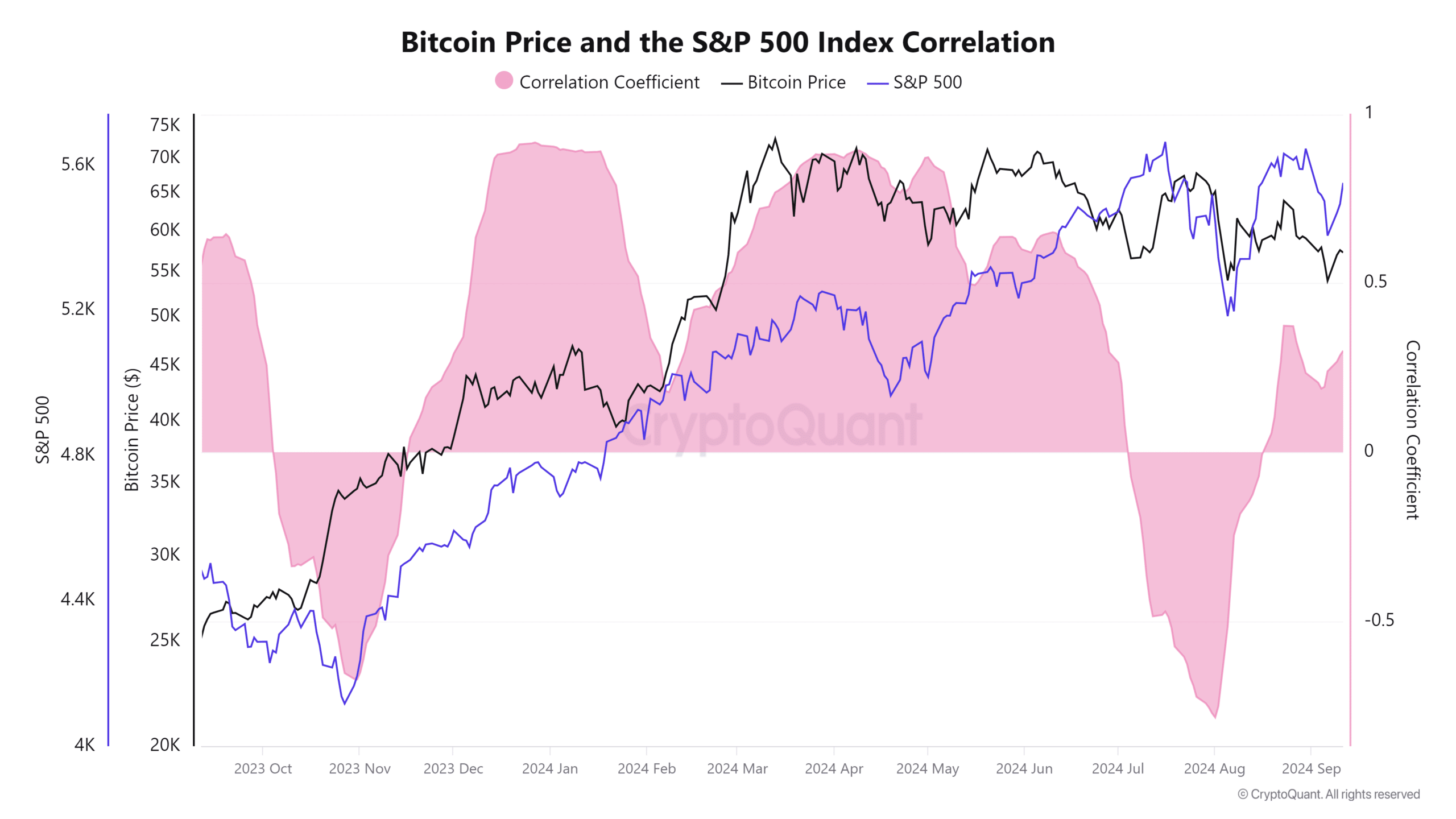

Bitcoin is mostly categorised as a probability-on asset, which is a term bolstered by how folk make investments in it. Essentially the most essential characteristic of this classification is that Bitcoin has historically demonstrated correlation with the S&P 500.

The correlation between Bitcoin and the S&P 500 most ceaselessly underscores investor diversification in the probability-on class. Nonetheless, there are cases where Bitcoin has lost its correlation with the stock market. This changed into evident in June and July, phases which were characterized by differing factors equivalent to Bitcoin’s involvement in politics.

In response to most up-to-date data, alternatively, Bitcoin is over again transferring in tandem with the stock market. The correlation coefficient bounced from its lowest point firstly of August and comprise change into definite in mid-August.

Rate cuts expectations are the humble denominator for this correlation. The united statesFederal Reserve is slated to preserve its subsequent FOMC meeting in the next 4 days. Expectations were overwhelmingly leaning against a sizeable fee carve. Such an outcome could possibly be favorable for the probability-on segment, one which encompasses both stocks and crypto.

Both Bitcoin and the stock market are expected to answer to the announcement. Essentially, most analysts preserve the consensus that a bullish outcome is extremely likely if the Fed decides to embark on aggressive fee cuts. Here, it’s. price noting that the correlation could additionally fair be lost further down the highway, particularly if Bitcoin takes off aggressively.

All eyes on Bitcoin miner provide

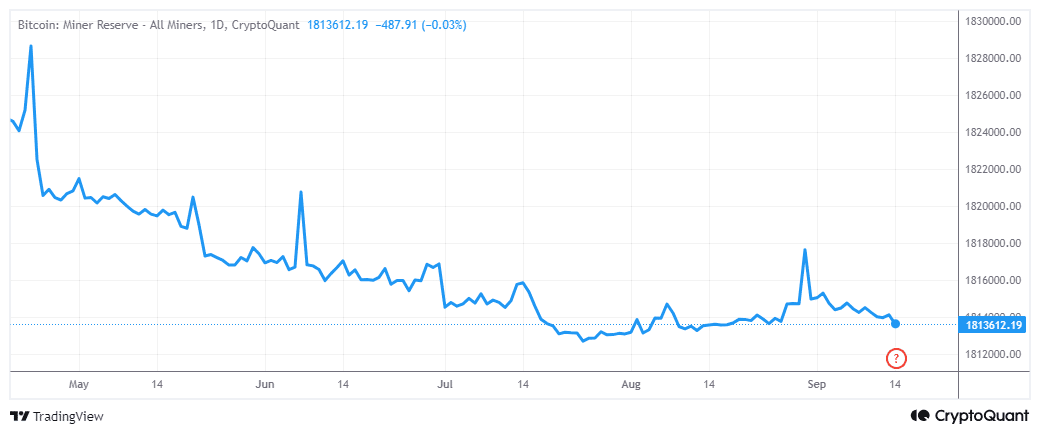

Speaking of bullish expectations, the market is currently taking a search signs of a vital rally. Essentially, a recent Santiment post identified that mining pockets balances could additionally fair offer a trusty signal when the next vital rally commences.

“Bitcoin and Ethereum mining wallets comprise viewed declining provide held since the first half of 2024. With this most up-to-date gentle rebound, search a jump in their mixed offers as a trusty signal the next bull flee is impending.”

Patrons will comprise to thus occupy a cease survey on miner reserves basically basically based on this evaluation. The miner reserves metric revealed that Bitcoin miner balances were declining since April. It demonstrated some uptick in July, nonetheless it soon retraced in favor of outflows.

We are able to peek basically basically based on the aforementioned prognosis that miner flows were within their 2024 bottom vary. This implies there is a vital likelihood of a pivot from this level, particularly now that Q4 is upright around the nook.

A mix of fee cuts and the uselections could additionally fair provide the fitting blend of catalysts to trigger yet every other vital market transfer. A shift in guard in Bitcoin miner reserves, particularly in favor of a pointy uptick, could additionally fair be viewed as great confirmation of when the next bull flee kicks off.