MUMBAI: The

stock market

ended Samvat yr 2080 (that follows conception to be one of many Indian calendars) on Thursday on a detrimental indicate with the sensex down 553 parts at seventy 9,389 parts, come its three-month low stage. On the NSE, Nifty closed decrease, at 24,205 parts, down 136 parts.

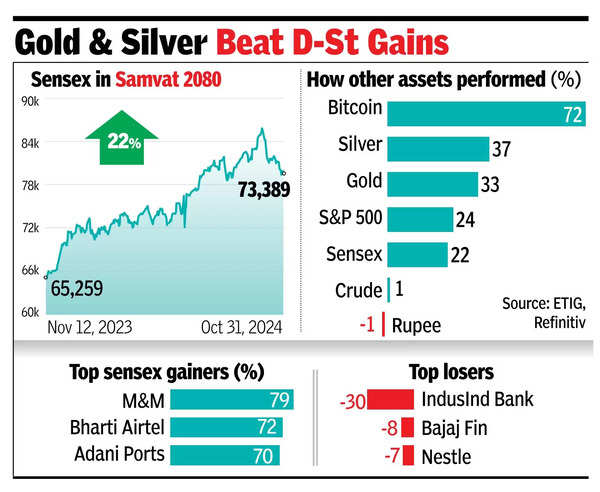

The closing month of the yr noticed sturdy selling by foreign funds that shaved off about 6% from every of the main indices. This, nonetheless, changed into as soon as in distinction to the positive factors within the stock market that additionally created wealth at extra special tempo. Take be conscious of this: Since closing Diwali (the day Samvat yr begins) on Nov 12, investors’ wealth in India has jumped Rs 128 lakh crore (about $1.5 trillion at contemporary replace charge) to Rs 453 lakh crore. This made Samvat 2080 basically the most necessary wealth-increasing yr on file.

The positive factors came on the support of a stable govt at the centre, dapper facing of the inflationary build no matter geopolitical uncertainties, sturdy macroeconomic fundamentals and file inflows by domestic funds which changed into as soon as at Rs 4.7 lakh crore. In response to Shripal Shah, MD & CEO of

Kotak Securities

, no matter the geopolitical concerns, domestic occasions devour elections, a lawful monsoon, sturdy macro indicators and Sebi real efforts to provide protection to investors private all contributed to a worthy and promising market ecosystem. “Particularly, we private considered a surge of alive to contemporary investors alive to to be half of India’s development account.”

On Thursday, NSE, the country’s main bourse, acknowledged that its investor inferior had crossed 20 crore. And within the mutual fund sector whereas the full property managed by the commerce changed into as soon as at about Rs 68 lakh crore, month-to-month contaminated inflows by the systematic funding conception (SIP) route changed into as soon as nearing the Rs 25,000-crore impress. The total three numbers are at lifestyles-excessive phases. The yr additionally noticed gold, basically the most cherished treasured steel amongst Indians fling to the second build by map of annual returns. When when in contrast with silver’s 37% scheme for the length of the yr, gold’s changed into as soon as 33%.

Among the unique funding opportunities, Bitcoin, with a return of 72% changed into as soon as the steady-performing asset class. On the facet of the returns spectrum, rupee and mistaken oil barely generated any return. The yr changed into as soon as additionally search to an irregular event when the opposition occasions were gunning for Sebi chief’s resignation on the support of allegations of battle of pastime, costs that the regulatory head denied The approaching yr, Samvat 2081, on the full is a tense yr for Indian equities.