The stock market is one amongst the greatest wealth creators out there. Over the prolonged traipse, the S&P 500 index has returned about 10% yearly all over the previous century, rewarding patient merchants who rob a buy-and-withhold skill to investing.

Some companies outperform the S&P 500 over prolonged sessions. These companies possess sturdy industry devices and capital and threat management, which lets in them to create stellar money flows it doesn’t matter what the financial system does.

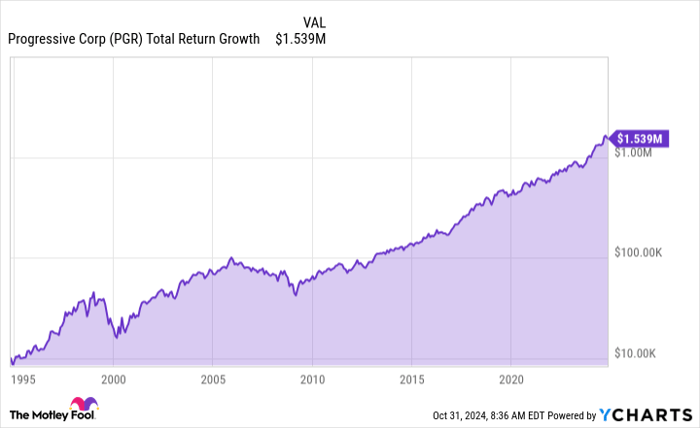

One beautiful firm that continues to indicate strength is Revolutionary (NYSE: PGR). The insurance firm has delivered extra special returns of 18.3% compounded yearly all over the previous three many years. Assign otherwise, patient merchants who invested $10,000 within the insurer three many years ago would be sitting on bigger than $1.5 million this day. Right here’s why Revolutionary can relieve handing over.

PGR Total Return Stage files by YCharts

Insurance protection companies present in kind money flows

Investing in insurance shares is now no longer as intriguing as investing in next-skills skills, but they may perhaps perchance perhaps also additionally be a essential piece of your varied portfolio. That’s on legend of insurance companies can present in kind money waft thanks to constant request as folks and agencies check to supply protection to themselves from catastrophic losses. Even the legendary investor, Berkshire Hathaway Chief Govt Officer Warren Buffett, has acknowledged that insurance is an awfully essential piece of Berkshire’s industry.

On the opposite hand, investing in only any insurance firm is now no longer real ample. The exchange is extremely aggressive, and it may perhaps perchance perchance also additionally be complicated for companies to stand out. Will possess to you check at the exchange, insurers, on moderate, barely ruin even. In other phrases, insurers receive only ample premiums to pay out claims and other expenses. Right here’s the build Revolutionary differentiates itself.

In 1965, Peter B. Lewis, the son of 1 in all Revolutionary’s founders, took over as CEO of the insurance firm. Lewis made a dedication that the firm would develop by constantly underwriting winning insurance insurance policies. This differed from the frequently accredited observe that insurance companies must peaceable ruin even on insurance policies and assemble their income from their investment portfolios as every other.

Revolutionary is one amongst the most easy at pricing threat

Revolutionary arena a aim to assemble $4 in income for every $100 in premiums it obtained, and it continues to try for this aim this day. In other phrases, the firm objectives to possess a combined ratio of 96%, which measures the ratio of a firm’s claims charges plus expenses divided by premiums peaceful.

All around the previous 22 years, Revolutionary has carried out a combined ratio of 96% or higher. All over that time, its combined ratio has averaged 91.8%, successfully below the exchange moderate of 100%. This solid underwriting performance comes all over just a few recessions and completely different at ease and arduous market environments that insurers possess confronted. Even last year, when car insurers posted their worst quarterly loss ratio in two many years, Revolutionary peaceable managed to meet its aim.

This solid underwriting is a testomony to Revolutionary’s dedication to skills and its skill to defend its edge within the auto insurance market. One instance of Revolutionary’s underwriting advantage is its exercise of telematics. The insurer became one amongst the first to exercise driver files, luxuriate in mileage driven, traipse, and braking time, to personalize charges for drivers.

Right here’s why Revolutionary can relieve handing over

Revolutionary’s industry is successfully positioned to develop alongside an expanding financial system. It will also additionally manufacture successfully if inflation reignites. JPMorgan Tear CEO Jamie Dimon has warned of rising authorities deficits, the decoupling of the arena financial system, and geopolitical tensions as most likely drivers of elevated inflation and former-time charges. The in kind request for car insurance provides Revolutionary pricing power, allowing it to adapt to rising charges.

This can even additionally income if hobby charges dwell elevated for the very prolonged timeframe. Revolutionary has a $72.3 billion investment portfolio, closely invested in mounted-income resources luxuriate in U.S. Treasuries. This year, the firm earned $1.3 billion in investment income, up from $874 million last year.

Revolutionary continues to outperform its peers, and last year became a huge instance of how the firm tailored to a intriguing working ambiance. The insurer has constantly performed successfully all over quite a lot of market and industry cycles and stays an beautiful stock for prolonged-timeframe merchants.

Could even peaceable you make investments $1,000 in Revolutionary upright now?

Sooner than you buy stock in Revolutionary, rob into consideration this:

The Motley Fool Stock Guide analyst group real identified what they suspect about are the 10 easiest shares for merchants to buy now… and Revolutionary wasn’t one amongst them. The ten shares that made the carve may perhaps perchance perhaps also create monster returns within the impending years.

Preserve in mind when Nvidia made this list on April 15, 2005… while you invested $1,000 at the time of our recommendation, you’d possess $813,567!*

Stock Guide provides merchants with a easy-to-observe blueprint for success, including guidance on building a portfolio, normal updates from analysts, and two new stock picks every month. The Stock Guide provider has bigger than quadrupled the return of S&P 500 since 2002*.

*Stock Guide returns as of October 28, 2024

JPMorgan Tear is an promoting accomplice of The Ascent, a Motley Fool firm. Courtney Carlsen has positions in Revolutionary. The Motley Fool has positions in and recommends Berkshire Hathaway, JPMorgan Tear, and Revolutionary. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and lift out now no longer essentially replicate these of Nasdaq, Inc.