The stock market has been hitting unique highs this year as pleasure continues to construct with appreciate to synthetic intelligence (AI) and the opportunities that would originate up for a total lot of agencies. However whereas retail traders had been eagerly buying up shares, Warren Buffett has been pretty quiet and doing more promoting than buying.

The Oracle of Omaha has cautioned traders previously “to be jumpy when others are greedy,” which reflects his total cautious technique to investing. Minimizing losses are a precedence for him, and AI doubtless would no longer fall into his circle of competence, which is what he makes a speciality of when deciding which shares to aquire.

Ought to aloof traders take Buffett’s conservatism in the markets this year as a red flag?

Valuations are high basically based mostly on historical stages

In the third quarter, Buffett persisted promoting shares, and Berkshire Hathaway‘s cash stability reached better than $325 billion, which is increased than the almost about $277 billion it reported a quarter earlier. He has been promoting shares of Apple and Financial institution of The United States for just a few sessions, two high holdings in the Berkshire portfolio, and hasn’t been making mountainous strikes with that cash, ensuing in a rising cash stability.

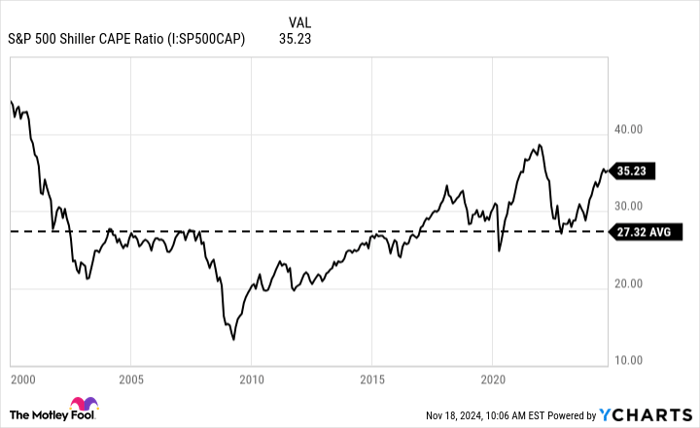

However given how costly the stock market has change into on the 2nd, it be per chance little surprise that he is taking a cautious residing. One metric traders must aloof pay shut consideration to is the S&P 500 Shiller mark-to-earnings (P/E) ratio, which averages inflation-adjusted earnings all over the final decade. At the original time, the ratio is well above what it has averaged since 2000. The old instances it has been this high, there had been foremost declines available in the market the following year.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller P/E ratio became as soon as increased in 2021. The following year, in 2022, the S&P 500 would fracture by better than 19%. In the early 2000s, the market underwent a foremost dot-com fracture attributable to the tech bubble. Many mark-oriented traders would possibly maybe agonize that the same would possibly maybe be taking place with AI shares on the original time; a total lot of them are trading at egregious multiples. Shareholders of Palantir Technologies, as an illustration, don’t seem to be balking at its big earnings just a few of better than 300.

A mark-centered possibility for traders to support in thoughts

Even whilst you are terrified about valuations or the chance of a fracture in the markets, it would possibly possibly probably no longer basically point out that you just would possibly want to aloof promote your total shares and pull your total cash out. If a correction takes residing, some shares will inevitably be hit unheard of tougher than others. Shares trading at more cheap valuations would possibly maybe climate the storm greater than shares which would be at outrageous multiples. Meanwhile, making an strive to time the market and waiting for ideal investing cases is no longer an optimal strategy as it would possibly possibly probably cease in you lacking out on beneficial properties along the style.

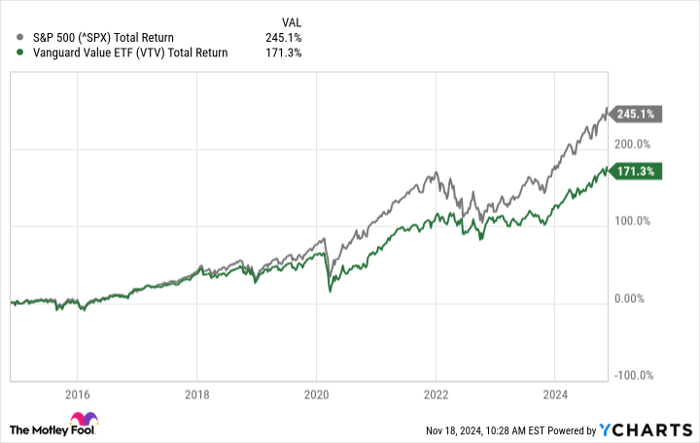

Another for traders is to support in thoughts an substitute-traded fund (ETF) which prioritizes mark investments. A stunning instance of that is the Vanguard Designate Index Fund ETF Shares (NYSEMKT: VTV). The fund has a low expense ratio of 0.04% and tracks the U.S. Immense Cap Designate index. With the standard preserving in the ETF averaging an earnings just a few of upright over 20, traders are getting exposure to more attractively priced shares than the total S&P 500 index, which is averaging a just a few of virtually about 26.

The cease preserving in the Vanguard fund is Buffett’s hang Berkshire Hathaway, nonetheless at upright 3% of the fund’s weight, it doesn’t signify a gigantic chunk of the total portfolio. Consumers will additionally earn earn accurate of entry to to many other blue chip shares with the ETF, including UnitedHealth Community and Home Depot. Historically, the fund has underperformed the S&P 500, nonetheless in a imaginable downturn, it would possibly possibly probably be the greater aquire, especially given how costly many growth shares are correct kind now.

Consumers must aloof put collectively for a imaginable correction

Timing the market is unsafe, nonetheless what’s going to even be even riskier is preserving shares which alternate at extremely high premiums because they can even be at possibility of a promote-off at a 2nd’s survey.

When shares are extremely valued, expectations will additionally be high, and any rate that a company would possibly maybe face distress would possibly maybe instructed traders to hit the promote button. It doesn’t must aloof be a defective earnings document, as corrections would possibly maybe occur at any time traders initiate to scent ache forward. That is why it be important to support in thoughts valuations and doubtlessly pass cash into more reasonably priced shares which would possibly maybe no longer easiest provide more protection all over a downturn nonetheless can have more upside in the end.

And whilst you will doubtless be risky which shares to aquire or promote, a stunning possibility is to support in thoughts the Vanguard Designate ETF or the same forms of investments which prioritize mark shares.

Ought to aloof you invest $1,000 in Vanguard Index Funds – Vanguard Designate ETF correct kind now?

Sooner than you aquire stock in Vanguard Index Funds – Vanguard Designate ETF, relief in thoughts this:

The Motley Fool Stock Consultant analyst crew upright known what they shriek are the 10 easiest shares for traders to aquire now… and Vanguard Index Funds – Vanguard Designate ETF wasn’t one of them. The 10 shares that made the lower would possibly maybe produce monster returns in the arrival years.

Steal into fable when Nvidia made this list on April 15, 2005… whilst you invested $1,000 on the time of our advice, you’d own $898,809!*

Stock Consultant gives traders with an effortless-to-practice blueprint for success, including steering on building a portfolio, extra special updates from analysts, and two unique stock picks every month. The Stock Consultant service has better than quadrupled the return of S&P 500 since 2002*.

*Stock Consultant returns as of November 18, 2024

Financial institution of The United States is an promoting accomplice of Motley Fool Money. David Jagielski has no residing in any of the shares mentioned. The Motley Fool has positions in and recommends Apple, Financial institution of The United States, Berkshire Hathaway, Home Depot, Palantir Technologies, and Vanguard Index Funds-Vanguard Designate ETF. The Motley Fool recommends UnitedHealth Community. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and construct no longer basically shriek those of Nasdaq, Inc.