- PSX features 3,134.63 parts or 2.98% to conclude at 108,238.96.

- Analyst says quite a lot of factors including price nick using market.

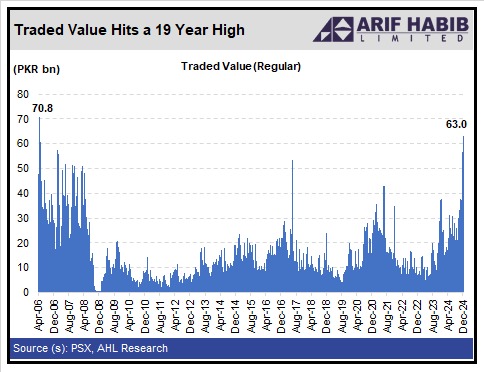

- PSX achieves its absolute best market job in nearly 19 years.

The inventory market persevered its ascent to detrimental 108,000 parts imprint on Thursday, pushed by a procuring spree, rising anticipation of a appreciable hobby price nick in the Mumble Financial institution of Pakistan’s (SBP) upcoming monetary policy meeting on December 16, file-low inflation and strengthening financial indicators.

The Pakistan Stock Substitute’s (PSX) benchmark KSE-100 Shares Index climbed 3,134.63 parts, or 2.98%, to conclude at 108,238.96 parts, after hitting an intraday excessive of 108,345.98 parts.

“Solid liquidity, real macro indicators, anticipated price nick in December’s MPC, and perceived low political threat are all using the market,” talked about Muhammad Saad Ali, Director of Study at Intermarket Securities Ltd. “Stock-particular info will be serving to the bullish sentiment,” he added.

The PSX added yet one more milestone by reaching its absolute best market job in nearly 19 years, with a traded value of Rs63 billion ($227 million). This marks the absolute best job in the conventional market since April 17, 2006, underscoring the strength of investor hobby and liquidity.

Finance Minister Mohammad Aurangzeb has also reaffirmed the authorities’s dedication to financial stabilisation by structural reforms and adherence to the Global Financial Fund (IMF) programme.

Speaking at an match in Islamabad, Aurangzeb highlighted that the present story deficit has narrowed, inflation has dropped to a 70-month low, and the country’s economy is exhibiting signs of recovery.

The Ministry of Finance also reported improved monetary steadiness, attributing it to ongoing reforms.

As inflation continues to plummet expectations are rising for additional monetary easing, signalling a brighter financial outlook.

The SBP has already slashed hobby rates by 700 basis parts (bps) all the contrivance by four consecutive conferences since June, bringing the price to fifteen%. Experts widely rely on yet one more valuable low cost, with most analysts predicting a nick of in spite of the total lot 200 bps.

A ballotconducted by Topline Securities printed that 71% of respondents quiz a minimal low cost of 200 bps, with 63% forecasting exactly 200 bps, 30% looking out at for 250 bps, and 7% trying forward to a better nick.

The case for monetary easing is supported by November’s Client Impress Index (CPI) inflation, which clocked in at 4.9%—its lowest in 78 months and effectively under the SBP’s target vary of 5-7%.

“This reading locations inflation critically under the target, leaving sizable room for additional price cuts,” Topline Securities renowned.

The decline in inflation is attributed to sooner food disinflation and unfavourable electrical energy designate adjustments. Analysts predict inflation will remain in single digits in the coming months, putting forward an ultimate ambiance for monetary easing.

The alternate records launched by the Pakistan Bureau of Statistics (PBS) has additional bolstered market sentiment. Pakistan’s alternate deficit narrowed by 7.39% at some level of the first five months (July-November) of the present fiscal year, standing at $8.651 billion in contrast to $9.341 billion at some level of the same duration last year.

Exports rose by 12.57% to $13.69 billion, whereas imports elevated by 3.90% to $22.342 billion. November’s alternate deficit narrowed even additional, losing 18.60% year-on-year to $1.589 billion in contrast to $1.952 billion in November 2023.

Thursday’s rally follows a courageous session on Wednesday, when the KSE-100 Shares Index climbed 545.26 parts, or 0.52%, to conclude at 105,104.33 parts after reaching an intra-day excessive of 105,473.56 parts