The US stock market’s strongest two-year rally for the reason that dot-com bubble is heading into its subsequent astronomical take a look at as corporations commence releasing quarterly earnings, offering a critical intestine take a look at on whether valuations have outrun the underlying actuality.

Creator of the article:

Bloomberg Data

Jessica Menton

Published Jan 11, 2025 • 4 minute read

![d]y6ia2u4zi{5}5ot83qm5jc_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2025/01/improving-margins-sp-500-operating-margins-are-forecast-to-.jpg?quality=90&strip=all&w=288&h=216&sig=7WUQRcpmdy5pMDDM5IjSwQ)

(Bloomberg) — The US stock market’s strongest two-year rally for the reason that dot-com bubble is heading into its subsequent astronomical take a look at as corporations commence releasing quarterly earnings, offering a critical intestine take a look at on whether valuations have outrun the underlying actuality.

Article express material

Article express material

On Friday, the S&P 500 Index slid 1.5% — its worst plunge since mid-December — as an surprising surge in hiring solidified speculation that the Federal Reserve obtained’t reduce hobby charges again till the 2nd half of the year.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read primarily the most popular files in your city and all the contrivance thru Canada.

- Unique articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.

- Day-to-day express material from Monetary Times, the enviornment’s leading global commerce e-newsletter.

- Limitless on-line web admission to to read articles from Monetary Submit, National Submit and 15 files net sites all the contrivance thru Canada with one fable.

- National Submit ePaper, an digital reproduction of the print edition to scrutinize on any plan, portion and observation on.

- Day-to-day puzzles, together with the Unique York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read primarily the most popular files in your city and all the contrivance thru Canada.

- Unique articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.

- Day-to-day express material from Monetary Times, the enviornment’s leading global commerce e-newsletter.

- Limitless on-line web admission to to read articles from Monetary Submit, National Submit and 15 files net sites all the contrivance thru Canada with one fable.

- National Submit ePaper, an digital reproduction of the print edition to scrutinize on any plan, portion and observation on.

- Day-to-day puzzles, together with the Unique York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Fabricate an fable or signal in to proceed with your reading expertise.

- Glean entry to articles from all the contrivance thru Canada with one fable.

- Fragment your thoughts and be a part of the conversation in the feedback.

- Relish extra articles per 30 days.

- Glean electronic mail updates out of your authorized authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Fabricate an fable or signal in to proceed with your reading expertise.

- Glean entry to articles from all the contrivance thru Canada with one fable

- Fragment your thoughts and be a part of the conversation in the feedback

- Relish extra articles per 30 days

- Glean electronic mail updates out of your authorized authors

Label In or Fabricate an Story

or

Article express material

However the bigger self-discipline is the excessive bar build aside of residing by merchants’ estimates: The experiences are anticipated to squawk that the resilient financial system elevated the earnings of the corporations in the S&P 500 by 7.3% throughout the fourth quarter from a year earlier, per files compiled by Bloomberg Intelligence. That’s the 2nd-highest pre-season forecast in the past three years, and it threatens to build aside equities on a shaky footing if the outcomes — or the outlook for the months ahead — fall short.

With the S&P 500 priced for roughly 23% earnings-per-portion boost in the next Three hundred and sixty five days, the estimates embedded in stock costs are strangely excessive, BI files squawk. Bottom-up consensus forecasts — a form of forecasting future stock performance by together with up particular person analyst estimates for each of the S&P 500 corporations — are calling for 13% EPS boost in 2025, which contrivance those projections would establish on to with regards to double to justify the build aside the S&P 500 trades.

“We haven’t considered a hurdle this excessive since 2018,” said Michael Casper, senior equity strategist at BI. “It’s going to be valuable extra difficult for corporations to proceed to beat profit estimates this year than in 2024 for the reason that bar used to be valuable decrease then.”

By signing up you consent to receive the above e-newsletter from Postmedia Network Inc.

Article express material

Article express material

Fourth-quarter earnings season will officially kick off on Wednesday, led by financial bellwethers JPMorgan Prance & Co., Citigroup Inc. and BlackRock Inc. More key corporations will articulate outcomes the next week, together with, Netflix Inc., Procter & Gamble Co. and 3M Co.

Right here’s a gape at 5 key subject matters to stare as the outcomes roll in:

Broadening Enhance

One closely-watched self-discipline is whether or no longer the earnings-boost momentum will scramble past the largest tech corporations, which might well provide a grab to a couple of the market’s laggards.

With the financial system performing wisely, corporations out of doorways of astronomical tech are anticipated to document a third straight quarter of earnings boost, with income estimated to upward push 4% and scramble toward double-digit increases by the predominant three months of 2025, per files compiled by BI.

Tech corporations will restful be a key market driver. However merchants are appealing for the so-known as Comely Seven corporations — Nvidia Corp., Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Tesla Inc. — to document a slowdown in boost: Profits are anticipated to upward push by 22%, as compared with moderate earnings boost of 34% in 2024, when the the rest of the S&P 500 rose 4.5%, per BI.

Article express material

Substitute, Tariffs & Taxes

Investors are also taking a gape for insight into how President-elect Donald Trump’s tax-reduce, tariff and deregulatory policies will trickle thru Company America. Whereas a few of his plans threaten to upend global commerce and fan inflation pressures, the stock market has been focused extra on the upside of a professional-boost agenda.

Yet the hold of tax cuts being eyed in Washington might presumably merely handiest decrease the tax burden on the S&P 500 by about half as valuable as the 2017 kit, per BI’s Casper. He said that adds one more hurdle to assembly the steep EPS boost baked into the S&P 500 over the next Three hundred and sixty five days.

The buck’s most popular surge is one more originate request: Whereas that would merely take the sting off the impact of a tariff fabricate bigger by cheapening import costs, it will probably also darken the outlook for multinational corporations by lowering export ask and the payment of out of the country earnings.

Revenue Revisions

Traders are searching at a key indicator identified as earnings-revision momentum, a gauge of upward-to-downward adjustments to anticipated per-portion earnings over the next Three hundred and sixty five days for the S&P 500. It has been hovering in detrimental territory, BI files squawk, indicating that Wall Avenue analysts are trimming their estimates heading into earnings season.

Article express material

Whereas that isn’t uncommon, it might presumably be an early signal of transferring sentiment. The tech sector’s 12-month forward EPS revision momentum, as an illustration, has dropped for 11 of the final 12 weeks, driven by markdowns for excessive-flying semiconductors corporations.

Three of 11 sectors in the S&P 500 are poised to have considered profit boost scramble by double digits in the final three months of 2024, together with communication companies and know-how, in conjunction with previously unloved groups adore health care. Energy is forecast to put up a roughly 30% profit contraction from a year earlier in the fourth quarter, BI files squawk.

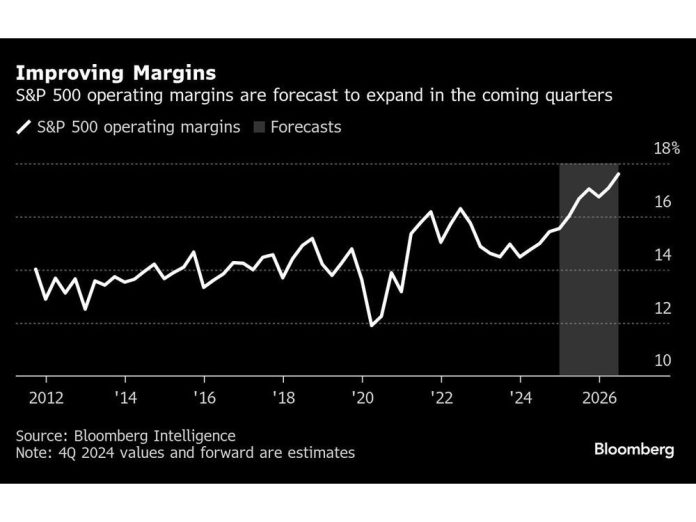

Monitoring Margins

Traders will wait on a end witness on working margins after inflation got right here down from the put up-pandemic surge, easing some payment pressures. Analysts search working margins for the fourth quarter at with regards to 16%, with the worst of the grief in the rear-scrutinize replicate as forecasts make stronger in the coming quarters, files compiled by BI squawk.

Europe’s Earnings Tide

Expectations for European earnings are some distance extra subdued as the continent contends with stunted financial boost at dwelling and in China, a very mighty buying and selling partner for its luxurious-items and automobile corporations. The likelihood of US tariffs is a dismay for its export-heavy industries in 2025.

Article express material

Profits for the Stoxx 600 are projected to have risen good 3% in 2024, as compared with 8% for the S&P 500, and can seemingly path again this year, BI files squawk. The level of curiosity might be on automakers adore Volkswagen AG that are going thru threats from protectionist policies, tepid ask in China and the loss of US tax credit for some plug-in vehicles. Luxurious corporations together with LVMH and Gucci-guardian Kering SA might be bellwethers of person spending patterns.

“The astronomical screech for European equities is that the boost atmosphere remains very no longer easy,” said Lilian Chovin, head of asset allocation at Coutts.

—With the assistance of Sagarika Jaisinghani and Michael Msika.

Article express material